Good EU Project financial management starts here – how to set up a HORIZON proposal budget?

1st November 2023 at 2:11 pm

Setting up a Horizon Europe (HORIZON) proposal budget for a so-called multi-beneficiary consortium with project partners from different European and sometimes non-European countries is not for the faint-hearted. While personnel costs and general other direct costs that can be directly attributed to the project appear to be straightforward, in-kind contributions, subcontracting, equipment and other cost items seem to be harder to plan. However, our experience from many years of EU proposal preparation and budget planning from FP7, H2020 to HORIZON at accelopment, has shown that the costs in all four main categories are difficult to estimate. Why so?

Estimating the costs of a three-, four- or five-year research and innovation project with many unknown factors in terms of the progress of work and research results requires expertise in the planned research and financial requirements according to the local rules of the partner countries as well as in HORIZON financial rules.

The first blog post of our HORIZON finance series handled cash flow in Horizon Europe projects – from pre-financing to final payments. In this post, we will provide insights based on our experience from developing budgets for our first 22 successful HORIZON proposals.

Good Project Financial Management Starts with Forward Planning

To calculate future and realistic costs of a research project, it is critical to delve into the details presented in its work packages and related tasks. In Part B, section 3.1, this is exemplified through the “Description of work” for each work package (Table 3.1b). These work package details not only help identify potential costs but also form the core justification for the proposed budget. This is then complemented by the following four tables providing extra information and justifications on the four main cost categories:

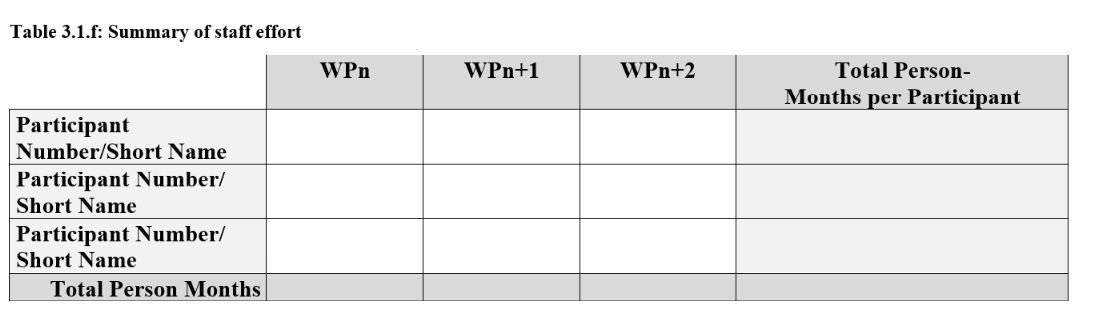

1. Personnel costs: First, the necessary staff effort needs to be estimated, ideally separately for different salary categories. This staff effort, expressed in person-months (PMs), needs to be multiplied by the monthly staff costs for each salary category. Gauging the required staff effort at this stage can be challenging, but defining the necessary roles of your personnel (e.g., R&D, engineer, clinician, developer, administration personnel, project managers, etc.) for each task and aligning them with the relevant work packages (WPs) can facilitate a realistic and accurate calculation of the PMs needed from each applicant. If the detailed categories are not known, an average monthly staff cost rate can be used. The monthly rates must include all mandatory employer costs, such as social security and employee insurance. Although the European Commission does not request these details at the proposal stage, they are required in the regular (periodic) financial statements and reports. Hence, it makes sense to have this information available for the budget planning. Once the total staff effort (person-months) required for the successful implementation of the tasks is estimated, the information should be summarised per participant and work package in Table 3.1.f below:

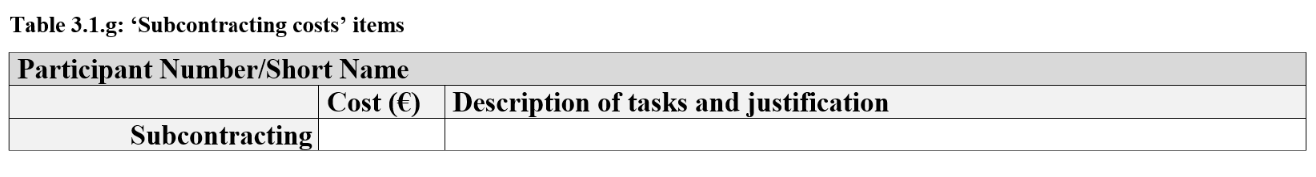

2. Subcontracting: Before even considering subcontracting, ensure that the tasks you are looking to outsource truly require external expertise not found within your consortium. While it might seem convenient, remember that subcontracting should ideally be your last resort. If you do decide to outsource some or parts of your activities, there are several key guidelines to keep in mind. Firstly, the tasks you outsource should never be core to your project, and while budgeting, only an estimate should be allocated without explicitly naming any subcontractor in the proposal. The latter measure is crucial as it is mandatory to adhere to the “best value for money” principle or the lowest price, all while avoiding potential conflicts of interest. This means that subcontracts must be tendered, i.e., most public institutions must follow their local/national public procurement procedures, while private entities need to request a minimum of three offers from suitable suppliers. How you will ensure this must be described in Table 3.1.g.

It is also worth noting that beneficiaries are not permitted to subcontract amongst themselves, and in most cases, subcontracting to affiliated entities is also off the table. Crucially, no core project milestones or deliverables should ever be entrusted to a subcontractor. Lastly, if a beneficiary does opt for subcontracting, they must understand that they remain wholly accountable for their subcontractor’s actions to ensure they deliver quality work in a timely manner. The general Model Grant Agreement (MGA) does not set a specific limit, but it is generally advised to keep subcontracting costs under 15% of the total project costs. In case you foresee subcontracting in your proposal, the costs will need to be described and justified as in Table 3.1.g below.

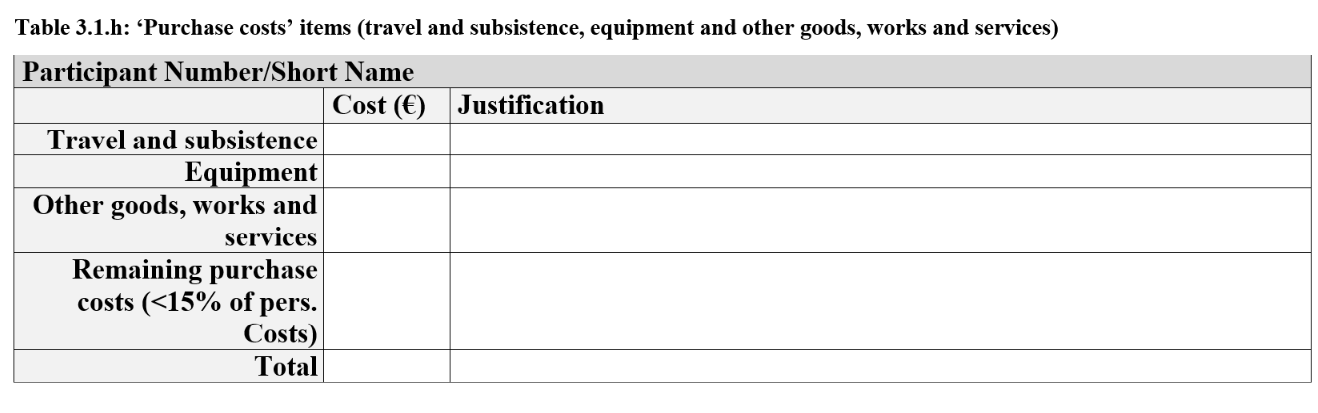

3. Purchase costs: Details and reasons for the purchase costs in these categories are required for each partner: travel, subsistence, equipment, and other goods, works and services. In the latter subcategory, you will account for various project-related costs, from consumables like promotion materials, packaging, and project management software to costs for dissemination, communication, and patenting. As this is a rather broad category, it is advisable to split these costs into subcategories such as materials, consumables, and IPR to enhance cost management. Additionally, this section encompasses the reimbursement for the Certificate on Financial Statements (CFS). The CFS, provided by an external auditor, reviews all your financial statements to validate them for the European Commission and is obligatory for all beneficiaries requesting a contribution above the €430.000 threshold.

The rule is that each partner should justify their foreseen purchase costs in Table 3.1.h in case they exceed 15% of their total allocated personnel costs. For Associated Partners, it is recommended to include all the cost details, even if they are below the 15% threshold, as their budget details are not included in the Part A online forms.

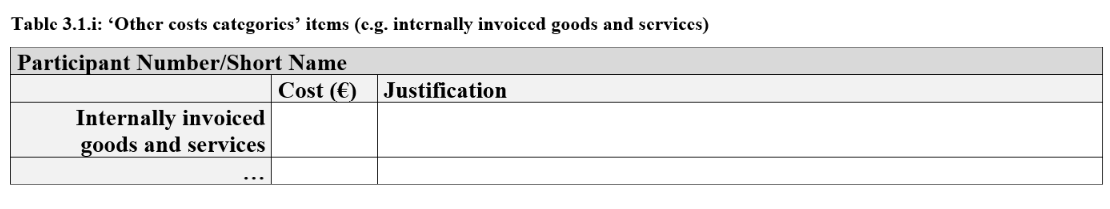

4. Other costs categories: Beyond the previously mentioned categories, the Horizon Europe project’s budget can also include several “other cost categories” such as financial support to third parties, internally invoiced goods and services, transnational access to research infrastructure unit costs, etc. If your project incorporates any of these, it’s necessary to offer a justification under table 3.1i. It’s important to note that the majority of these ‘other cost categories’ are not eligible for the addition of the 25% flat rate for indirect costs.

Professional Budgeting Tools: A Key to Effective Financial Project Planning

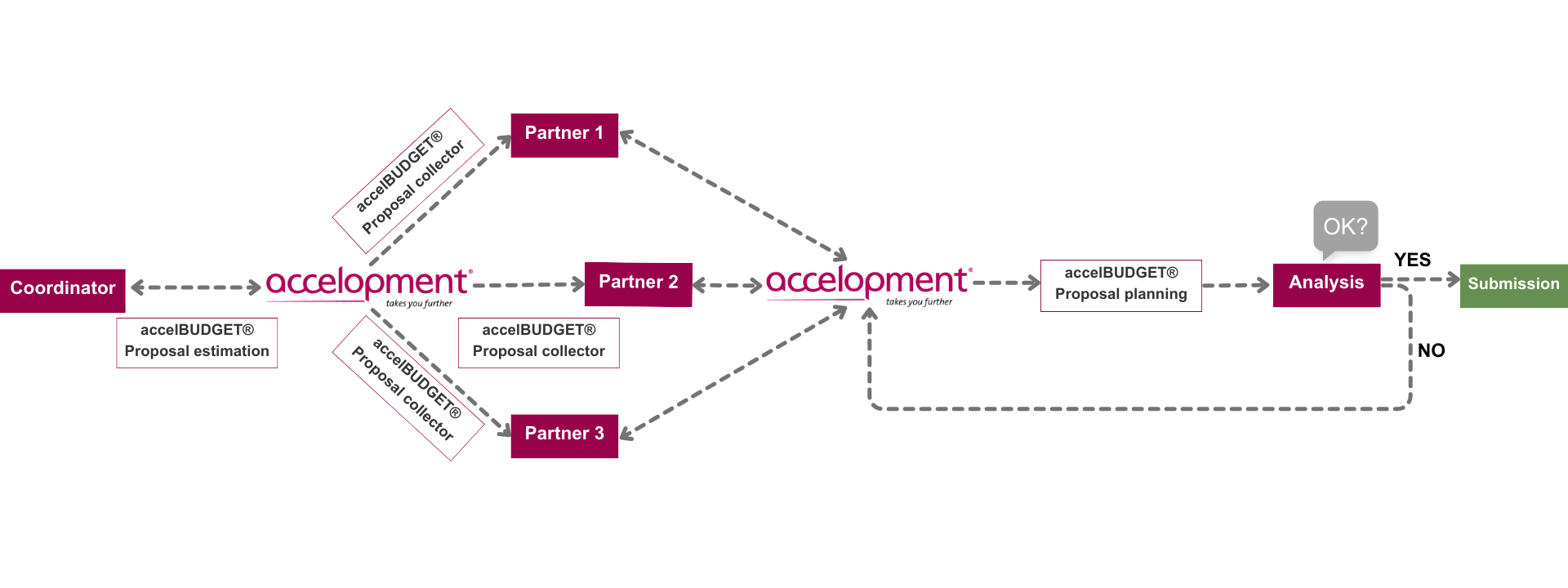

When preparing a proposal, we recommend starting the budgeting process as soon as possible or as soon as the work packages are defined because partners need to know possible or any budget limits while drafting their project tasks. On the other hand, the project coordinator and we at accelopment need to ensure that partners receive sufficient funding to deliver. Hence, it is important to avoid partners being either significantly under- or overspent later. To this end, we’ve developed a financial planning process as shown below and the relevant financial tools to support good financial project planning.

- As a first step in the financial planning process, a rough estimation of the total project cost is made early on together with the coordinator, using our accelBUDGET® Proposal estimation tool based on the WP tasks, type of action and characteristics of the different partners making up the consortium.

- Once the tasks, roles and responsibilities of every partner organisation are more concrete, our accelBUDGET® Proposal collector tool is sent out to every partner organisation. The idea is that every partner provides educated estimations of the costs it will incur over the full project duration along the four main cost categories mentioned above.

- In the meantime, we collect all the individual proposal budget collectors and compile them in our third accelBUDGET® Proposal planning tool. Once all partners have provided their cost estimations, the tool automatically calculates the total budget at the project level. Moreover, the smart tool automatically creates partner distribution visuals and summary tables needed for section 3.1.f – i and automatically flags cost items which need additional justifications. It also indicates which partners will need to obtain a CFS at the project end and should, therefore, include the associated costs for an external accountant/auditor.

- Once we have numbers from all partners, we analyse them to see if they fit all the call topic requirements and are below the maximum grant amount. From our many years of experience in setting up proposal budgets, we can say several iterations will have to be made where we discuss and adjust the individual partner budgets. In general, proposal writing is a turbulent process, a partner suddenly dropping out of the consortium or a shift in roles and responsibilities are not unusual factors which, in turn, influence the total proposal budget composition. This is why it’s important to start early on with setting up your proposal budget and why our tools are so valuable. Their flexible nature allows for the quick implementation of changes, which becomes the more crucial the closer you approach the proposal deadline.

| accelBUDGET® Proposal estimation | An intuitive tool designed to kick-start the budgeting process, offering coordinators an initial projection of the entire project’s financial needs by assessing tasks, actions, and consortium partner attributes. |

| accelBUDGET® Proposal collector | A tailored tool dispatched individually to each partner organisation where they can provide their cost estimations for the entire project duration, ensuring a detailed financial overview across core cost categories. |

| accelBUDGET® Proposal planning | A comprehensive financial aggregator that seamlessly compiles partner financial data to provide an overarching project budget view, facilitating the instant generation of key statistics, distribution visuals, summary tables, and crucial budget alerts, ensuring streamlined financial planning. |

Our three proposal budgeting tools have proven invaluable for Research and Innovation Actions (RIAs) and Innovation Actions (IAs). Over the years, they’ve been meticulously refined and have become a standard in all our proposal writing activities. Among their chief assets is their integration capability; they feed seamlessly into our project finance management tools used for project implementation, which will be covered in the next blog of this finance series. Stay tuned!

Good financial project planning – a key task in our proposal writing service

Over the years, accelopment has consistently demonstrated its expertise in assisting a diverse set of proposals, with notable successes including ThermoBreast, CONcISE, and PEPPERONI. From the intricacies of Horizon 2020 to the latest shifts in Horizon Europe, we’ve adapted and refined our methods to meet the ever-evolving standards and growing expectations. Given the complexity of proposal writing and detailed financial planning, our team remains dedicated to providing clear and accurate support. If you’re navigating the challenges of upcoming calls or seeking expert financial guidance, don’t hesitate to get in touch with one of our finance specialists!

Dr. Johannes Ripperger

Research & Innovation Manager

Robin Vanneste

Business & Finance Associate